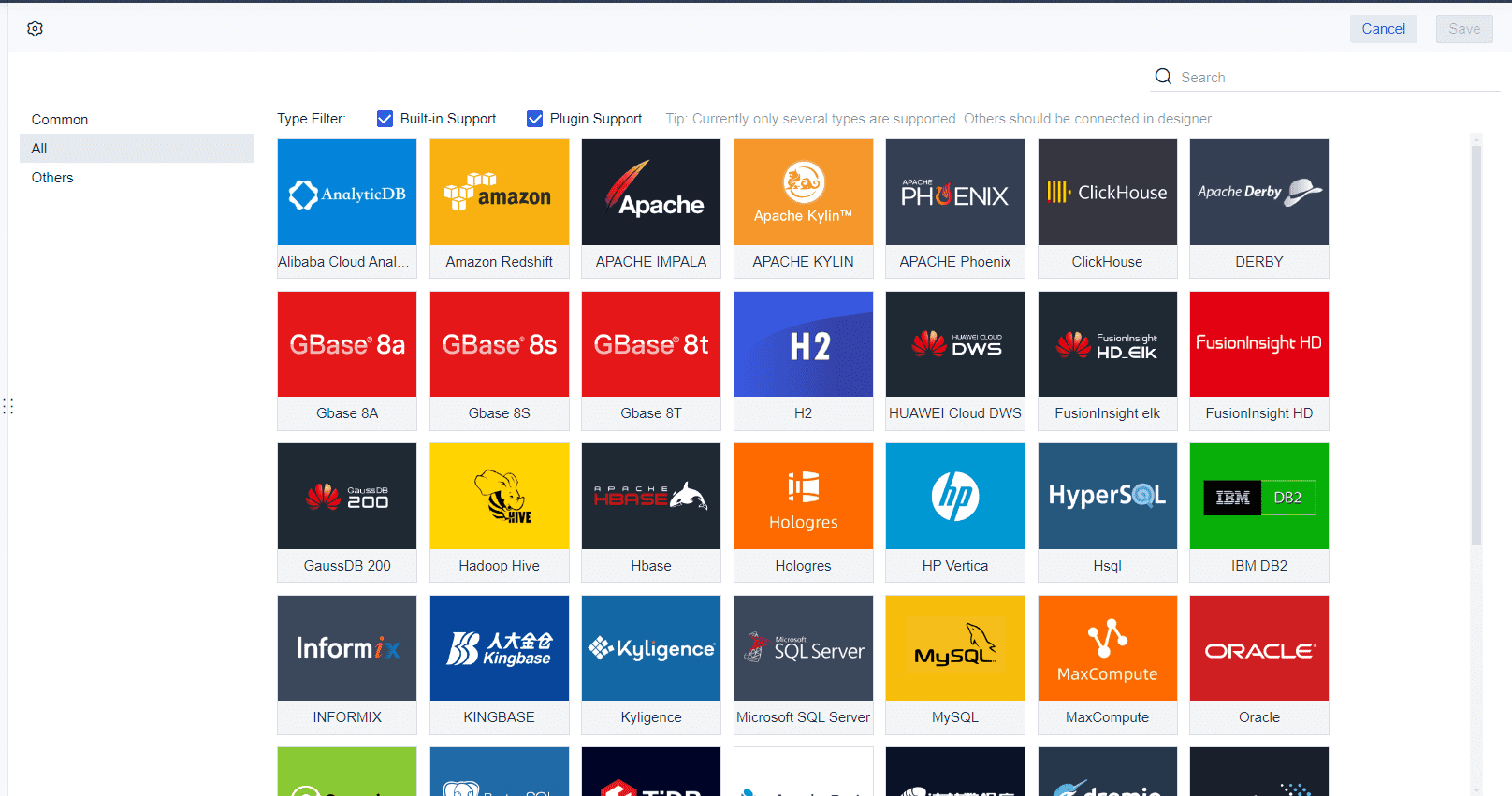

You see ESG reporting shaping the way companies operate worldwide. Nearly 86% of large companies now disclose some ESG information, showing rapid growth in transparency. Investors, regulators, and customers expect you to share clear ESG data. The chart below highlights how regions like Europe and Asia-Pacific lead in ESG adoption.

![4[1].jpg](https://media.finebi.com/strapi/4_1_52cc7b7e20.jpg)

FineReport from FanRuan gives you digital tools to collect, manage, and report ESG data efficiently.

ESG reporting gives you a structured way to share your company’s progress on environmental, social, and governance issues. You use this process to communicate your efforts and results to investors, regulators, and customers. ESG reporting builds trust and shows your commitment to responsible business practices. When you publish a report, you help others understand your impact and your goals for improvement.

ESG reporting is not just about compliance. It is a tool for building transparency and stakeholder trust. You show how your company manages risks, creates value, and supports long-term growth.

The table below summarizes the most widely accepted definitions and elements of ESG reporting in business:

| Aspect | Definition and Key Elements |

|---|---|

| ESG Reporting | Disclosure of an organization’s environmental, social, and governance data, articulating progress and performance. It is a procedural approach covering ecological conservation, social empowerment, and equitable governance. It serves as a communication tool promoting transparency, trust, and improvement opportunities. |

| Environmental | Focuses on a company’s impact on nature, including climate change mitigation, pollution and waste reduction, resource management, biodiversity conservation, and animal welfare. |

| Social | Concerns a company’s interaction with people and communities, emphasizing ethical working conditions, community and indigenous relations, and human rights. |

| Governance | Involves internal practices and controls such as fair executive compensation, equity, anti-corruption, political transparency, board diversity, and responsible tax practices. |

| Frameworks | Includes Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), Task Force on Climate-related Financial Disclosures (TCFD), Carbon Disclosure Project (CDP), Science Based Targets Initiative (SBTi), United Nations Global Compact (UNGC), Carbon Disclosure Standards Board (CDSB), and International Integrated Reporting Council (IIRC). These frameworks guide consistency, comparability, and reliability in ESG reporting globally. |

You can break down ESG reporting into three main pillars. Each pillar covers a different area of your business:

Tip: When you address all three pillars in your sustainability reporting, you give a complete picture of your company’s values and performance.

To create a strong ESG report, you need accurate and reliable data. You collect ESG metrics from many sources, such as energy use, employee surveys, supply chain audits, and board meeting records. Managing this data can be complex, especially if you have multiple locations or systems.

Digital tools like FineReport from FanRuan make ESG reporting much easier. You can use drag-and-drop features to design reports and dashboards. FineReport lets you collect real-time data, validate entries, and combine information from different databases. You can input large volumes of data using forms and visualize your ESG metrics with over 50 types of dynamic charts. This helps you monitor, analyze, and update your sustainability reporting quickly and accurately.

You also face challenges in ESG reporting, such as collecting data from different sources, ensuring quality, and keeping up with changing regulations. FineReport helps you overcome these challenges by integrating data, standardizing collection methods, and supporting compliance with global ESG reporting frameworks. You can automate data entry, schedule regular updates, and share your ESG report with stakeholders in a clear and engaging way.

Note: Using a centralized platform like FineReport improves data accuracy and transparency. You can focus on making better decisions and showing your progress in sustainability reporting.

ESG reporting shapes how you manage your company’s risks, growth, and reputation. You use ESG to meet legal requirements, build trust with investors and customers, and unlock new business opportunities. When you create a report, you show your commitment to responsible practices and long-term success.

Governments around the world now require companies to disclose ESG information. You must follow strict rules to stay in compliance with regulations.

You see ESG reporting move from voluntary to mandatory in many regions. New rules require you to report climate risks, governance, and greenhouse gas emissions. You must use digital formats and third-party assurance. These changes push you to improve your data collection and internal controls. You need strong systems to meet deadlines and avoid penalties.

FineReport helps you meet these requirements. You can automate data collection, validate entries, and create reports that match global standards. FineReport supports compliance with regulations by making it easy to gather, organize, and share ESG data.

Tip: Early adaptation to new ESG rules gives you a strategic advantage. You can use technology to simplify reporting and stay ahead of changing laws.

Investors, customers, and communities expect you to share clear ESG information. You see investors use ESG performance to guide their decisions. A recent survey found that 98% of investors assess ESG, and most now use structured reviews. Investors want to know how you manage risks and create value. They look at your governance, climate actions, and social impact before investing.

Customers also care about ESG. They choose companies that protect the environment and treat people fairly. You build trust by showing your ESG efforts in your report. Stakeholder engagement grows stronger when you share your goals and progress.

Stakeholder expectations differ by industry:

You need to tailor your ESG reporting to meet these expectations. FineReport lets you customize dashboards and reports for different stakeholder groups. You can visualize key metrics and share updates in real time.

Note: Meeting stakeholder expectations improves your reputation and attracts investment. You show leadership by responding to ESG concerns.

ESG reporting brings real business benefits. You use ESG to manage risks, improve operations, and drive growth. Research shows that strong ESG practices reduce financial risks and boost performance. Companies with high ESG ratings see better returns, higher innovation, and lower operational risks.

You expand risk management by including climate, social, and regulatory risks in your report. Proactive ESG reporting helps you avoid disruptions and costly crises. You build resilience and ensure business continuity.

Case studies show that effective ESG reporting leads to growth:

These companies use ESG reporting to improve efficiency, engage communities, and build trust. You can achieve similar results by embedding ESG into your strategy and using transparent reporting.

FineReport supports your business growth. You can track ESG metrics, set targets, and monitor progress. The platform helps you analyze data, identify risks, and report achievements. You make better decisions and show your commitment to sustainability.

Callout: ESG reporting is not just about compliance. You use it to create value, manage risks, and build a stronger business for the future.

When you adopt esg reporting, you unlock several important benefits for your business. These include greater transparency, stronger investor appeal, and real operational gains. Let’s explore how each of these advantages can help you build a more resilient and successful organization.

You improve transparency by systematically disclosing your environmental, social, and governance performance. This increased transparency reduces information gaps between you and your stakeholders. When you share clear data, you build trust and show accountability. For example, Unilever’s consistent esg reporting has strengthened its brand reputation and investor confidence.

Transparent esg disclosures help you comply with regulations, attract investors, and uncover operational inefficiencies. You also enhance your brand reputation and build trust with customers and employees.

You see measurable improvements in compliance, financial performance, and stakeholder engagement when you focus on transparency.

Esg reporting makes your business more attractive to investors. You give investors the information they need to make informed decisions. By improving transparency and credibility, you show that you manage risks well. Investors prefer companies with strong esg practices and reliable reporting.

Standardized and credible esg reporting helps you build lasting relationships with investors and supports long-term growth.

You gain real operational benefits when you implement esg reporting systems. Companies have reported up to 10% energy savings by optimizing systems and using real-time data. Automation and integration of esg data allow you to monitor performance instantly and make quick improvements.

Manufacturing companies now use advanced esg reporting technologies, such as AI-powered analytics and real-time emissions tracking. These tools help you meet regulatory demands and improve efficiency.

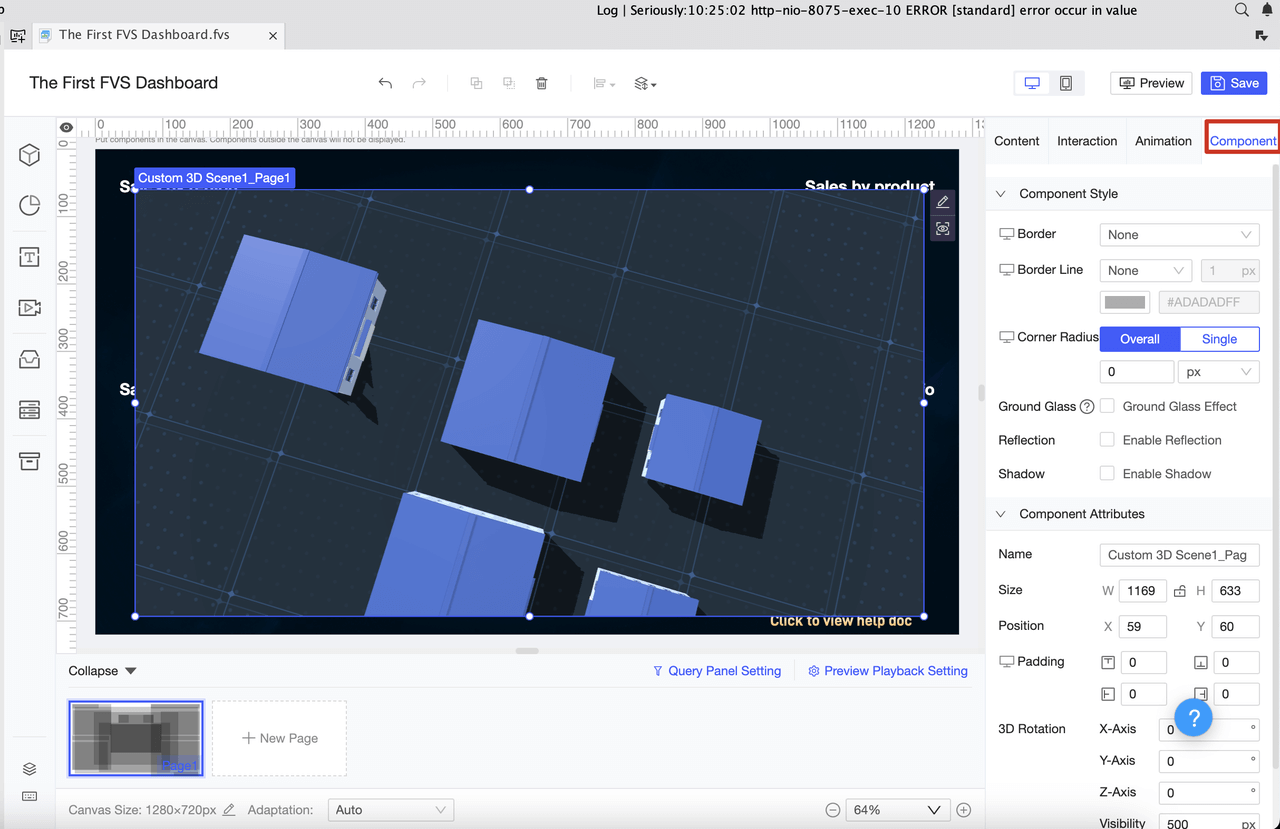

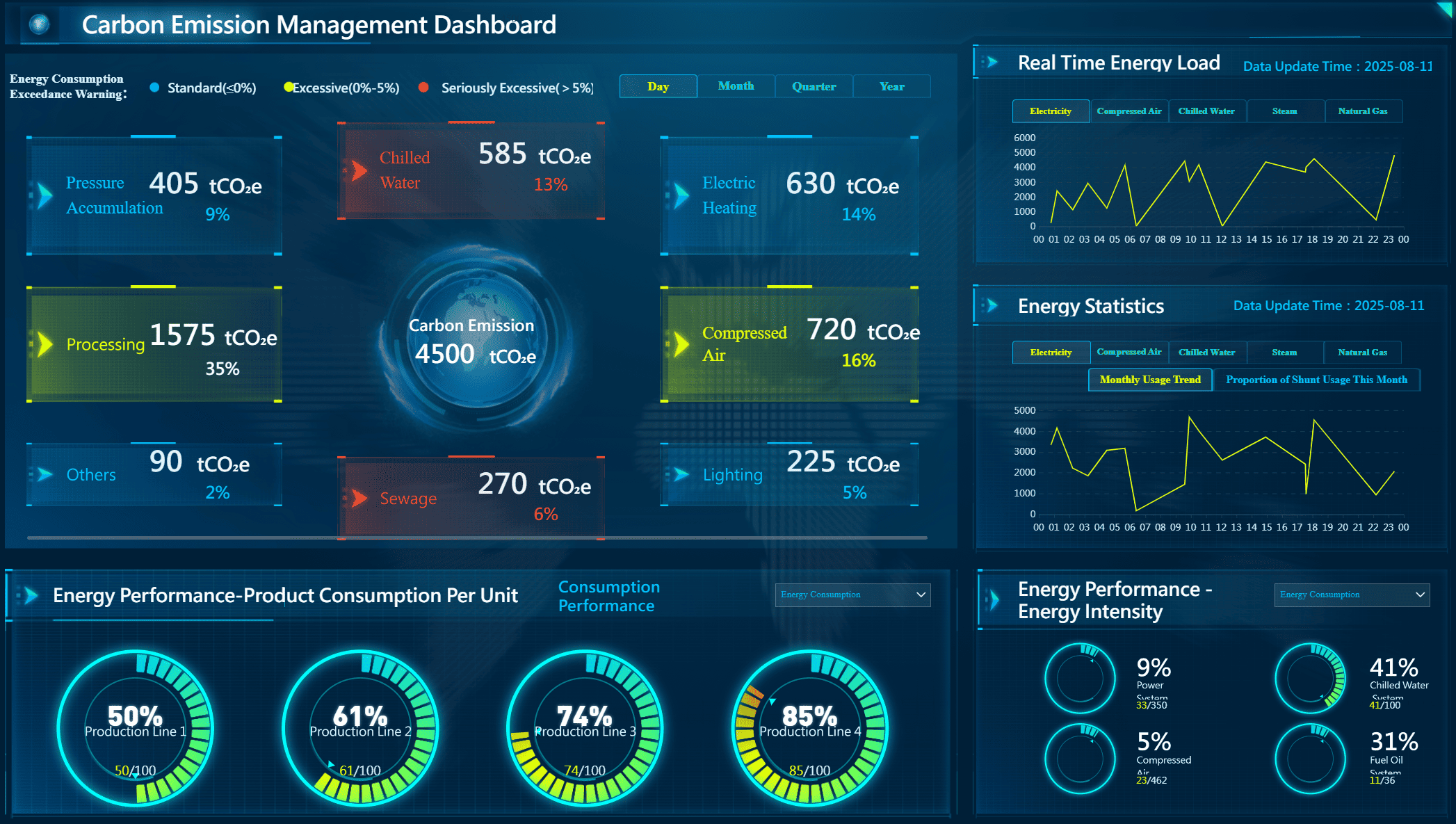

![5[1].jpg](https://media.finebi.com/strapi/5_1_df53567878.jpg)

FanRuan’s EHS and risk management solutions show how digital platforms can centralize esg data, support compliance, and drive continuous improvement. You can use dashboards to monitor safety, manage risks, and ensure your esg goals are met.

By embracing esg reporting, you create value for your business, your investors, and your community.

You can improve your esg reporting by using a carbon emission management dashboard. This tool helps you track and report your emissions data with accuracy and clarity. To design an effective dashboard, you should:

You can also use advanced data management tools, IoT sensors, and AI to collect and analyze esg metrics in real time. These features help you spot trends, reduce errors, and share results with your board or stakeholders.

Tip: A well-designed dashboard makes it easier for you to meet esg requirements and take action on your sustainability goals.

A power management dashboard gives you a clear view of your company’s energy use and supports your esg strategy. You should include both quantitative and qualitative esg metrics. For example, track renewable energy use, greenhouse gas emissions, and employee feedback on energy-saving programs.

Key best practices include:

| Category | Key Metrics |

|---|---|

| Environmental | Greenhouse gas emissions, Renewable energy use, Water security, Waste management |

| Social | Employee engagement, Supply chain management, Data protection |

| Governance | Board composition, Investor relations, Conflict of interest policy |

You can use technology to customize your dashboard and link esg performance to business outcomes.

You can support your esg goals by using an energy management dashboard that connects to smart meters and IoT devices. This dashboard collects real-time data on energy use and carbon emissions across your operations. Leading companies use AI and analytics to track progress, forecast trends, and generate automated reports.

Your dashboard should:

Interactive dashboards make it easier for you to manage energy use, reduce risks, and improve your company’s image. By focusing on esg metrics, you can drive continuous improvement and meet your sustainability commitments.

Creating a strong ESG report starts with a clear plan. You need to follow a few key steps to make your reporting process effective and reliable. These steps help you build a comprehensive ESG strategy and meet stakeholder expectations.

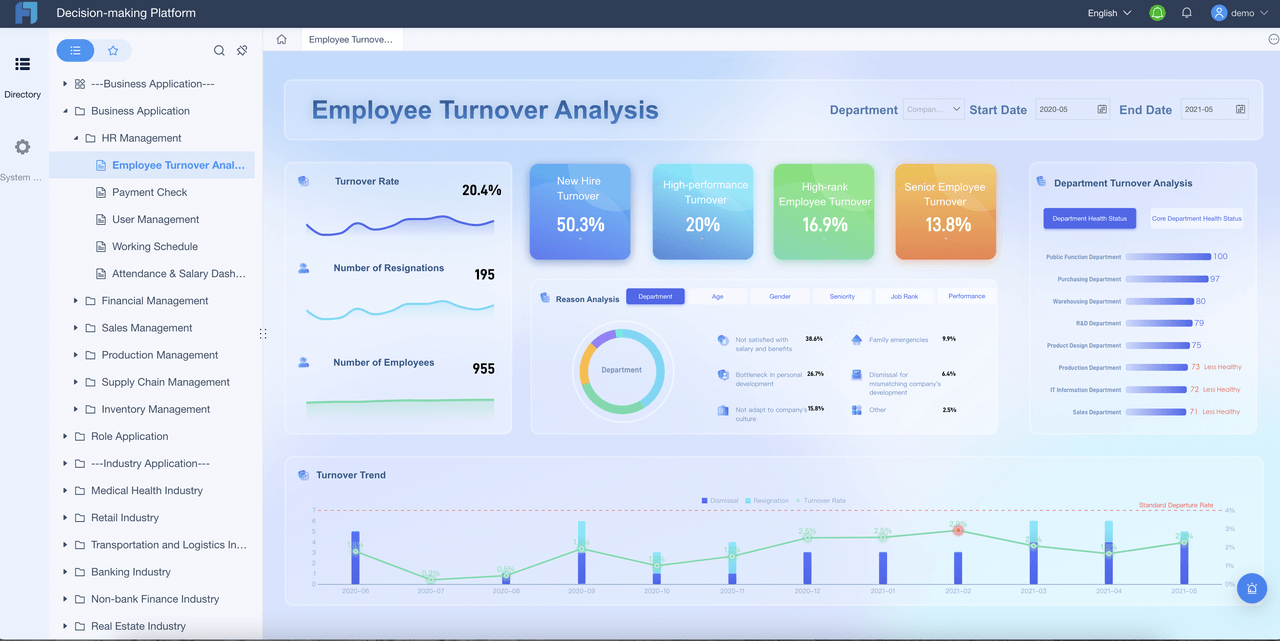

You should select an ESG reporting framework that fits your industry, size, and goals. There is no single framework that works for every business. Many companies use more than one to cover all their ESG-related practices. Popular ESG reporting frameworks include GRI, SASB, CDP, CDSB, DJSI, FFBB, and GRESB. Each offers unique advantages, such as global recognition, industry-specific standards, or strong environmental focus.

![6[1].jpg](https://media.finebi.com/strapi/6_1_62c4fa7d9c.jpg)

You should compare frameworks based on your reporting needs, regulatory requirements, and stakeholder interests. Companies often align their ESG reporting with investor expectations and competitor practices.

You need a skilled team to manage ESG reporting. Your team should include members with ESG training, data analysis skills, and strong communication abilities. You benefit from diverse backgrounds, such as finance, sustainability, HR, IT, and marketing. HR plays a key role in supporting ESG goals by providing data on diversity, training, and employee well-being. Using people analytics for ESG reporting helps you track social metrics and improve transparency.

| Department/Role | Key Responsibilities and Qualifications |

|---|---|

| Corporate Reporting | Prepare and publish ESG reports; disclose risks; adapt financial reporting. |

| Sustainability Department | Oversee initiatives; ensure accurate ESG activity reporting. |

| Human Resources | Report on diversity, training, compensation, and well-being. |

| Environment, Health & Safety | Supply climate impact, emissions, safety data. |

| IT and Data Teams | Aggregate and process ESG data; ensure accuracy. |

| Marketing | Communicate sustainability efforts. |

| Investor Relations | Align ESG with investor expectations. |

Tip: Cross-functional collaboration and executive support help your team succeed.

You can use FineReport to streamline ESG reporting. FineReport lets you create visually appealing reports and dashboards with drag-and-drop design. You can integrate data from multiple sources, including mainstream databases, and combine ESG metrics for a complete view. The platform offers over 50 chart styles, including dynamic and 3D effects, making your ESG data easy to understand.

FineReport supports customizable dashboards, automated reporting, and drill-down features for detailed monitoring. You can validate data entries and ensure compliance with ESG standards. Open APIs allow IT teams to connect FineReport with existing systems, improving workflow and consistency.

Using FineReport helps you centralize ESG data, improve accuracy, and simplify reporting.

You need to monitor ESG performance regularly to drive continuous improvement. Start by setting clear ESG goals and KPIs. Track your progress against these targets and update your materiality assessments as regulations and business conditions change. Use technology and analytics to gain real-time insights and maintain a dynamic library of impacts, risks, and opportunities.

Regular reviews and updates to your ESG report lead to better scores and stronger accountability. Companies that increase disclosure often see improvements in ESG ratings. You should foster a culture of transparency and engage stakeholders through ongoing reporting.

Continuous monitoring and feedback loops help you adapt to new risks and opportunities, ensuring your ESG reporting stays relevant and effective.

You see ESG reporting driving business value and resilience. Companies with strong ESG practices often achieve higher market valuations and outperform peers. You can start your ESG journey by selecting a framework, using digital tools like FineReport, and seeking expert support.

Take the first step toward continuous ESG improvement and build a sustainable future.

Click the banner below to try FineReport for free and empower your enterprise to transform data into productivity!

Sustainable manufacturing explained and why it matters today

The Author

Lewis

Senior Data Analyst at FanRuan

Related Articles

9 Best Supply Chain Tools for Smarter Management in 2026

Find the best supply chain tools for 2025 to boost efficiency, gain real-time insights, and achieve smarter management for your business.

Lewis

Dec 18, 2025

Top 10 Supply Chain Tracking Software for 2026

Compare the top supply chain tracking software for 2026 to boost visibility, automate workflows, and leverage AI analytics for smarter decisions.

Lewis

Dec 18, 2025

Top 10 Supply Chain Management Software for Small Businesses

See the top 10 supply chain management software comparison for small businesses in 2026. Compare features, pricing, and scalability to find your best fit.

Lewis

Dec 18, 2025