An audit report serves as a critical tool for evaluating the financial health and operations of an organization in Malaysia. It provides an independent assessment of whether financial reporting aligns with legal and ethical standards of Malaysia. By doing so, it promotes transparency, ensuring that stakeholders in Malaysia have a clear understanding of a company’s financial standing.

Audit reports also strengthen accountability. They encourage organizations in Malaysia to maintain accurate records and comply with regulations of Malaysia. This oversight fosters trust among stakeholders and supports good corporate governance practices in Malaysia. Key benefits include:

An audit report is a formal document that provides an independent evaluation of an organization’s financial records. It serves as a tool to verify whether the financial statements accurately reflect the company’s financial position. Auditors, who are trained professionals, examine the records to ensure they comply with accounting standards and legal requirements. This process helps you, as a stakeholder, gain confidence in the organization’s financial integrity.

The quality of an audit report plays a significant role in building trust. Research shows that factors like the auditor’s tenure and the timeliness of the report influence its perceived reliability. While there is no universal definition of audit quality, characteristics such as effective audit committees and experienced auditors consistently lead to better outcomes. These elements ensure that the report provides a clear and accurate picture of the organization’s financial health in Malaysia.

The primary purpose of an audit report is to promote transparency and accountability. It ensures that the organization’s financial statements are free from material misstatements. This is crucial for maintaining the trust of investors, regulators, and other stakeholders. When you review an audit report, you can assess whether the company is managing its resources responsibly.

Another key purpose is to support the release of audited financial statements. These statements are essential for making informed decisions. For example, investors rely on them to evaluate the company’s profitability and stability. The audit function also helps organizations identify areas for improvement, ensuring compliance with regulations and enhancing operational efficiency.

Audit reports are prepared by independent auditors. These professionals are either part of external auditing firms or internal audit teams within the organization. External auditors are often preferred for their objectivity. They follow strict guidelines to ensure the accuracy and fairness of the report. Internal auditors, on the other hand, focus on improving internal processes and controls.

The role of audit professionals extends beyond verifying financial data. They also assess the organization’s risk management practices and compliance with laws. Their expertise ensures that the audit report meets the highest standards of quality and reliability. This, in turn, strengthens the organization’s reputation and fosters stakeholder confidence.

The title and introduction of an audit report set the stage for its content. The title clearly identifies the document as an audit report, ensuring readers immediately understand its purpose. The introduction provides essential context, such as the organization in Malaysia being audited, the financial period under review, and the standards followed during the audit. This section helps you grasp the scope and objectives of the report, offering a roadmap for what to expect in the subsequent sections.

The scope of the audit outlines the boundaries of the auditor’s work. It explains the areas examined, the methods used, and any limitations encountered during the process. This section ensures transparency by detailing the extent of the auditor’s evaluation. For example, it may specify whether the audit covered all financial records or focused on specific accounts. By understanding the scope, you can assess the thoroughness of the audit and its ability to provide reliable insights into the organization’s financial information reliability.

The auditor’s opinion is the most critical part of the audit report. It summarizes the auditor’s findings and provides a verdict on the accuracy of the financial statements. This section directly impacts the report’s credibility and your confidence in the organization’s financial health.

Auditors issue different types of opinions based on their findings. The table below explains these opinions and their influence on the report’s reliability:

| Type of Opinion | Description |

|---|---|

| Clean Report | Indicates full compliance with GAAP, enhancing credibility. |

| Qualified Report | Suggests non-compliance with GAAP, potentially reducing credibility and investor confidence. |

| Disclaimer Report | Issued when access to financial records is limited, which can undermine the report's credibility. |

| Adverse Audit Report | Indicates significant non-compliance with GAAP, severely damaging the credibility of the financial statements. |

A clean opinion assures you that the financial statements comply with accounting standards, while a qualified opinion highlights minor issues. However, a disclaimer or adverse opinion raises concerns about the organization’s financial practices. Understanding these distinctions helps you evaluate the audit quality and make informed decisions based on the report.

The Basis for Opinion section explains the foundation of the auditor’s conclusions. It outlines the auditor’s responsibilities and the scope of their work. This section emphasizes that the financial statements are prepared by the company’s management, while the auditor’s role is to evaluate them and express an opinion. By clearly defining these roles, the report builds transparency and trust.

Transparency in this section reassures stakeholders about the integrity of the audit process. When you read this part, you understand the methods and standards the auditor followed. For example, it may mention compliance with Generally Accepted Auditing Standards (GAAS) or International Standards on Auditing (ISA). These details show that the auditor adhered to professional guidelines, ensuring the reliability of their opinion.

This section also highlights the auditor’s independence. It confirms that the auditor conducted their work without bias or external influence. This assurance strengthens the credibility of the audit report and fosters confidence in the findings.

Additional Notes and Recommendations provide insights beyond the auditor’s opinion. These notes often explain specific observations or highlight areas for improvement. For instance, the auditor may identify inefficiencies in internal controls or suggest ways to enhance compliance with regulations.

When you review this section, you gain actionable insights that can help the organization in Malaysia improve its operations. Recommendations might include adopting better financial practices or addressing risks that could impact future audits. These suggestions are valuable for guiding strategic decisions and ensuring long-term success.

This section also serves as a communication tool between auditors and stakeholders. It bridges the gap between technical audit findings and practical applications. By offering clear and constructive feedback, it helps organizations in Malaysia align their processes with industry standards and stakeholder expectations.

Audit reports come in different types, each reflecting the auditor’s findings and the organization’s compliance with financial standards. Understanding these types helps you interpret the report and assess the organization’s financial health.

An unqualified audit report is the most favorable outcome. It indicates that the financial statements comply with accounting standards and present an accurate view of the organization’s financial position. Auditors issue this type of report when they find no material misstatements or irregularities during their evaluation.

You can think of it as a “clean bill of health” for the organization’s finances. This report reassures stakeholders, such as investors and regulators, that the company manages its resources responsibly. The release of audited financial statements with an unqualified opinion builds trust and enhances the organization’s credibility.

A qualified audit report suggests that the financial statements are mostly accurate but contain specific exceptions. These exceptions could arise from minor non-compliance with accounting standards or limitations in the scope of the audit.

For example, if the auditor cannot verify certain transactions due to incomplete records, they may issue a qualified opinion. While this report does not imply severe issues, it signals areas that need improvement. As a stakeholder, you should pay attention to the auditor’s notes to understand the nature of the exceptions and their potential impact.

An adverse audit report is the most serious type. It indicates that the financial statements do not comply with accounting standards and contain significant misstatements. This report raises red flags about the organization’s financial practices and overall integrity.

When you encounter an adverse opinion, it’s essential to investigate further. This type of report often points to major issues, such as fraudulent activities or severe mismanagement. It can damage the organization’s reputation and deter potential investors or partners.

Tip: Always review the auditor’s opinion carefully. It provides valuable insights into the organization’s financial practices and helps you make informed decisions.

A disclaimer of opinion occurs when the auditor cannot form a clear conclusion about the financial statements. This situation arises due to significant limitations in the audit process. For example, the auditor may not have access to essential records or sufficient evidence to verify the accuracy of the financial data. In such cases, the auditor issues a disclaimer to indicate that they cannot provide an opinion on the organization’s financial health.

This type of audit outcome often signals serious concerns. It suggests that the organization’s records are incomplete or unreliable. As a stakeholder, you should view a disclaimer of opinion as a red flag. It highlights the need for further investigation into the company’s financial practices. Understanding the reasons behind the disclaimer can help you assess the risks associated with the organization in Malaysia.

Note: A disclaimer of opinion does not necessarily mean fraud or misconduct. It simply reflects the auditor’s inability to gather enough evidence to make a judgment.

To better understand the types of audit opinions, let’s explore real-world scenarios:

These examples illustrate how audit opinions reflect the financial integrity of organizations in Malaysia. They also emphasize the importance of maintaining accurate and transparent records.

Audit reports play a vital role in ensuring the accuracy of financial reporting. They verify whether an organization’s financial statements reflect its true financial position. This process helps you trust the numbers presented and make informed decisions. Without audits, errors or misstatements could go unnoticed, leading to unreliable financial data.

Transparency is another key benefit of audit reports. They provide a clear view of how an organization in Malaysia manages its resources. When financial information is transparent, stakeholders gain confidence in the organization’s operations. This transparency fosters trust and strengthens relationships between the organization and its investors, employees, and customers.

The role of audit extends beyond numbers. It highlights areas where financial practices can improve. For example, auditors may recommend better internal controls to prevent future errors. These insights ensure that organizations in Malaysia not only meet legal requirements but also operate efficiently.

Regulatory compliance is essential for organizations in Malaysia to avoid penalties and maintain their reputation. Audit reports ensure that financial statements comply with laws and accounting standards. This compliance protects organizations in Malaysia from legal risks and demonstrates their commitment to ethical practices.

Audits also help you understand whether an organization in Malaysia follows industry-specific regulations. For example, manufacturing companies must adhere to environmental and safety standards. Audit reports provide evidence that these requirements are met, ensuring the organization in Malaysia operates responsibly.

By identifying areas of non-compliance, audits encourage organizations in Malaysia to take corrective actions. This proactive approach reduces risks and enhances operational reliability. When you see an audit report, you can trust that the organization in Malaysia is managing its responsibilities effectively.

Trust and transparency are the foundation of strong stakeholder relationships. Audit reports build this trust by providing an independent evaluation of an organization’s financial health. Stakeholders rely on these reports to assess whether the organization in Malaysia is managing its resources responsibly.

A survey revealed that 95% of respondents believe the board plays a key role in building and protecting stakeholder trust. Additionally, 77% say the board shares this responsibility with management, while 18% believe the board holds primary responsibility.

| Statistic | Percentage |

|---|---|

| Believe the board should play a key part in building and protecting stakeholder trust | 95% |

| Say the board shares responsibility with management | 77% |

| Believe the board has primary responsibility | 18% |

These findings highlight the importance of trust in organizational governance. Audit reports contribute to this trust by ensuring financial transparency and reliability. When stakeholders see accurate and transparent financial reporting, they feel confident in the organization’s ability to deliver on its promises.

The importance of trust extends to strategic decision-making. Audit reports provide insights that guide these decisions, ensuring they align with the organization’s goals. By fostering trust, audits strengthen stakeholder relationships and support long-term success.

Audit reports play a crucial role in shaping an organization’s strategic decisions. They provide you with a clear understanding of the company’s financial health, enabling you to make informed choices. By analyzing the findings, you can identify areas where resources are being used effectively and where improvements are needed. This insight helps you allocate budgets wisely and prioritize initiatives that align with organizational goals in Malaysia.

The role of audit extends beyond financial accuracy. It highlights operational inefficiencies and uncovers opportunities for growth. For example, an audit might reveal that a department is overspending due to outdated processes. Addressing this issue can free up funds for innovation or expansion. Similarly, the report may identify underperforming assets, guiding you to reallocate resources for better returns.

Audit reports also enhance the reliability of your strategic planning. They ensure that decisions are based on accurate and transparent data. This reliability builds confidence among stakeholders, making it easier to secure support for new projects or investments. When you rely on audit findings, you reduce the risk of making decisions based on incomplete or inaccurate information.

Tip: Use audit insights to evaluate the long-term impact of your strategies. This approach ensures that your decisions contribute to sustainable growth and align with the organization’s vision.

Audit reports are invaluable for identifying risks and uncovering opportunities for improvement. They provide a detailed assessment of potential threats to the organization’s financial and operational stability. By addressing these risks proactively, you can safeguard the company’s assets and reputation.

To understand how audits achieve this, consider the following key metrics:

| Metric | Description |

|---|---|

| Risk Control Effectiveness | Measures the effectiveness of safeguards in preventing incidents and ensuring compliance. |

| Compliance and Audit Findings | Regular reviews help identify strengths and weaknesses in adherence to policies and regulations. |

| Risk Exposure Value | Estimates potential losses by assessing likelihood and impact, prioritizing high-risk areas. |

These metrics demonstrate how audits evaluate both financial and operational risks. For instance, risk control effectiveness ensures that the organization’s safeguards are functioning as intended. Compliance reviews highlight areas where policies need strengthening. Risk exposure value helps you focus on high-priority areas, minimizing potential losses.

Audit reports also reveal opportunities for improvement. They might suggest streamlining processes to enhance efficiency or adopting new technologies to reduce costs. For example, if the report identifies delays in procurement, you can implement digital tools to speed up the process. These improvements not only mitigate risks but also drive operational excellence.

Note: Regular audits ensure that risks are continuously monitored and addressed. This proactive approach fosters a culture of accountability and continuous improvement.

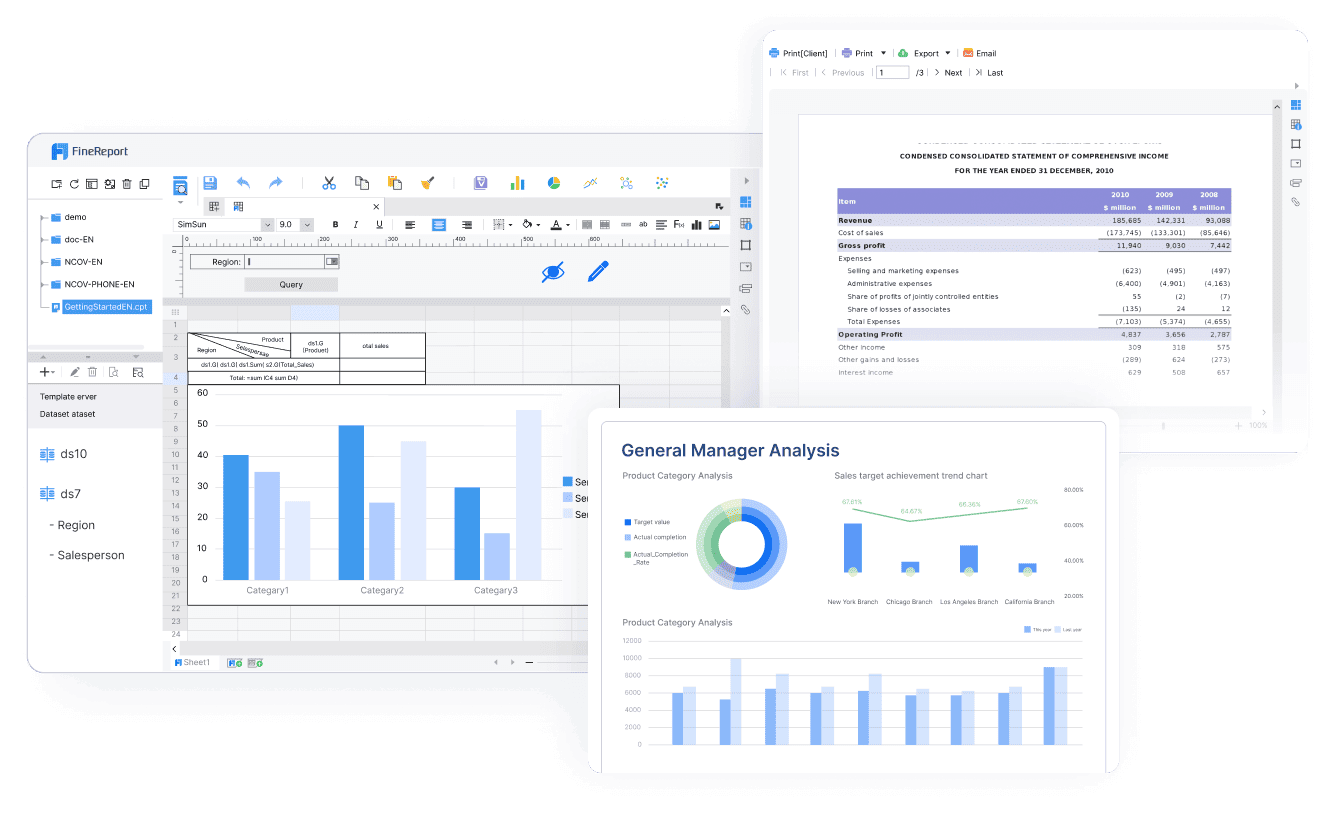

FineReport simplifies the process of creating audit reports. Its drag-and-drop interface allows you to design reports quickly without needing advanced technical skills. You can connect to multiple data sources and generate highly formatted documents that meet your organization’s requirements.

Automated scheduling is another feature that saves time. You can set up periodic tasks to generate and distribute reports automatically. This ensures stakeholders receive timely updates without manual intervention. FineReport also supports collaboration, enabling teams to work together on report development while maintaining data accuracy.

Tip: Use FineReport's scheduling feature to automate recurring audit tasks. This reduces errors and improves efficiency.

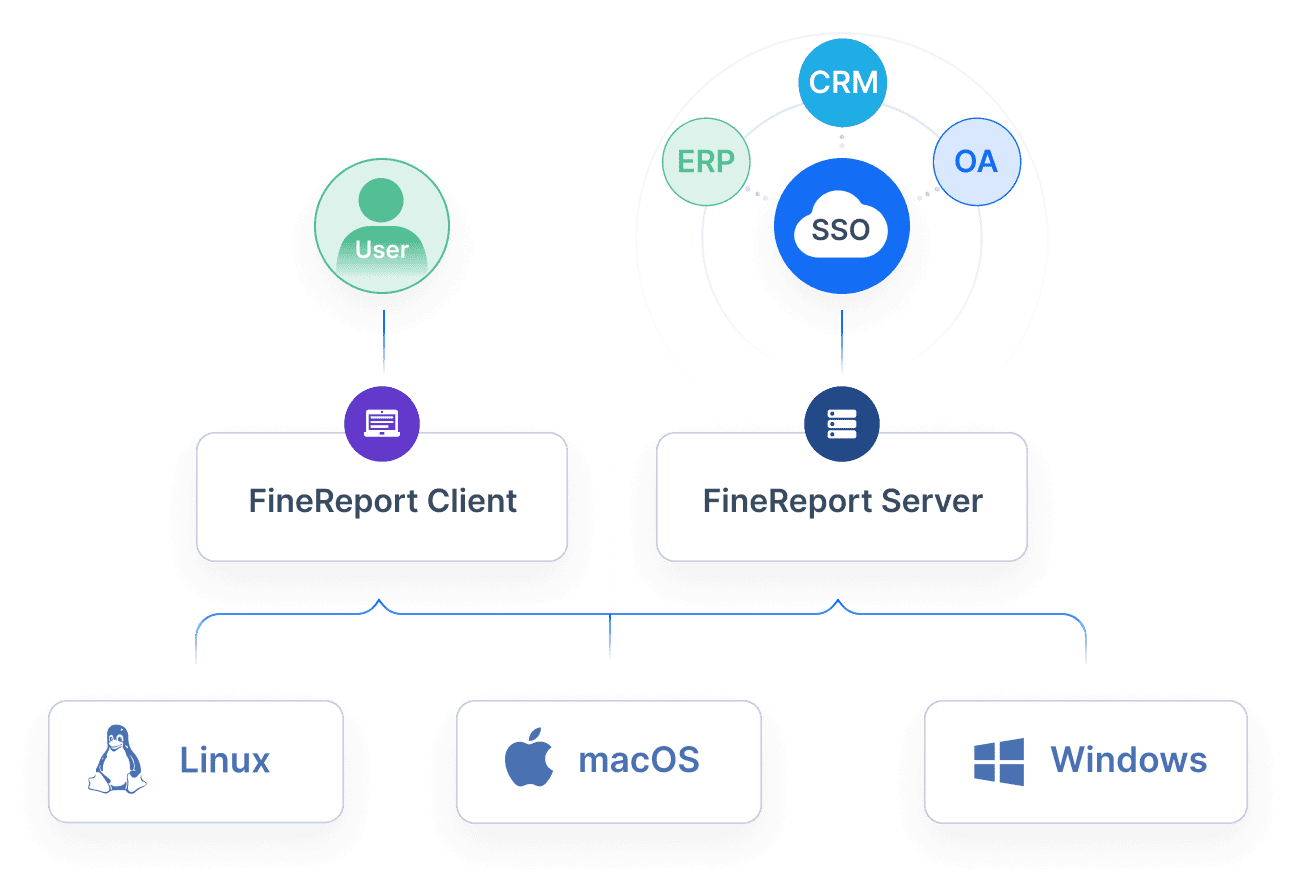

FineReport connects seamlessly to various databases and systems, ensuring all relevant data is integrated into one platform. This unified approach eliminates data silos and enhances the accuracy of your audits. You can combine financial, operational, and compliance data to create a comprehensive view of your organization’s performance in Malaysia.

The software supports real-time data synchronization, allowing you to access the latest information during audits. This ensures your reports reflect current conditions, making them more reliable for decision-making. FineReport’s ability to handle large datasets also makes it ideal for organizations in Malaysia with complex audit requirements.

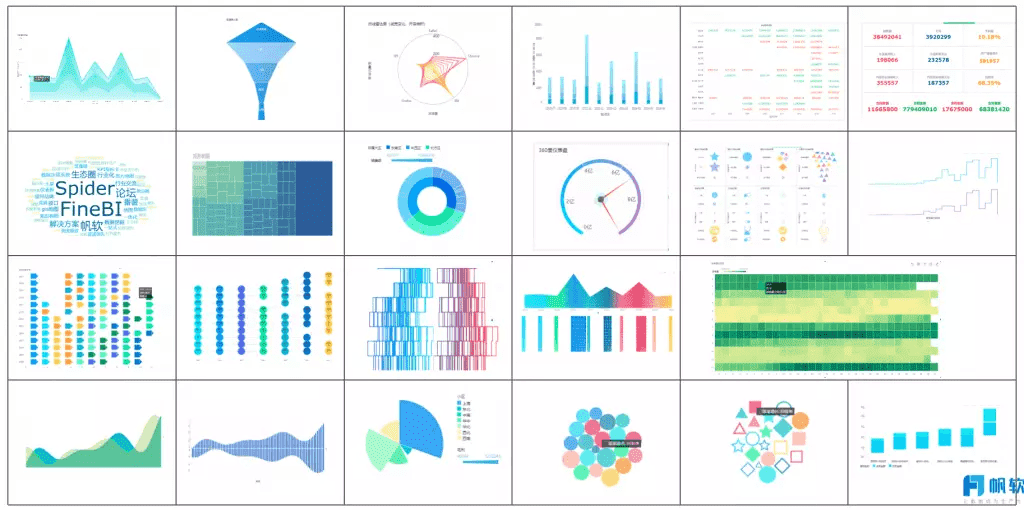

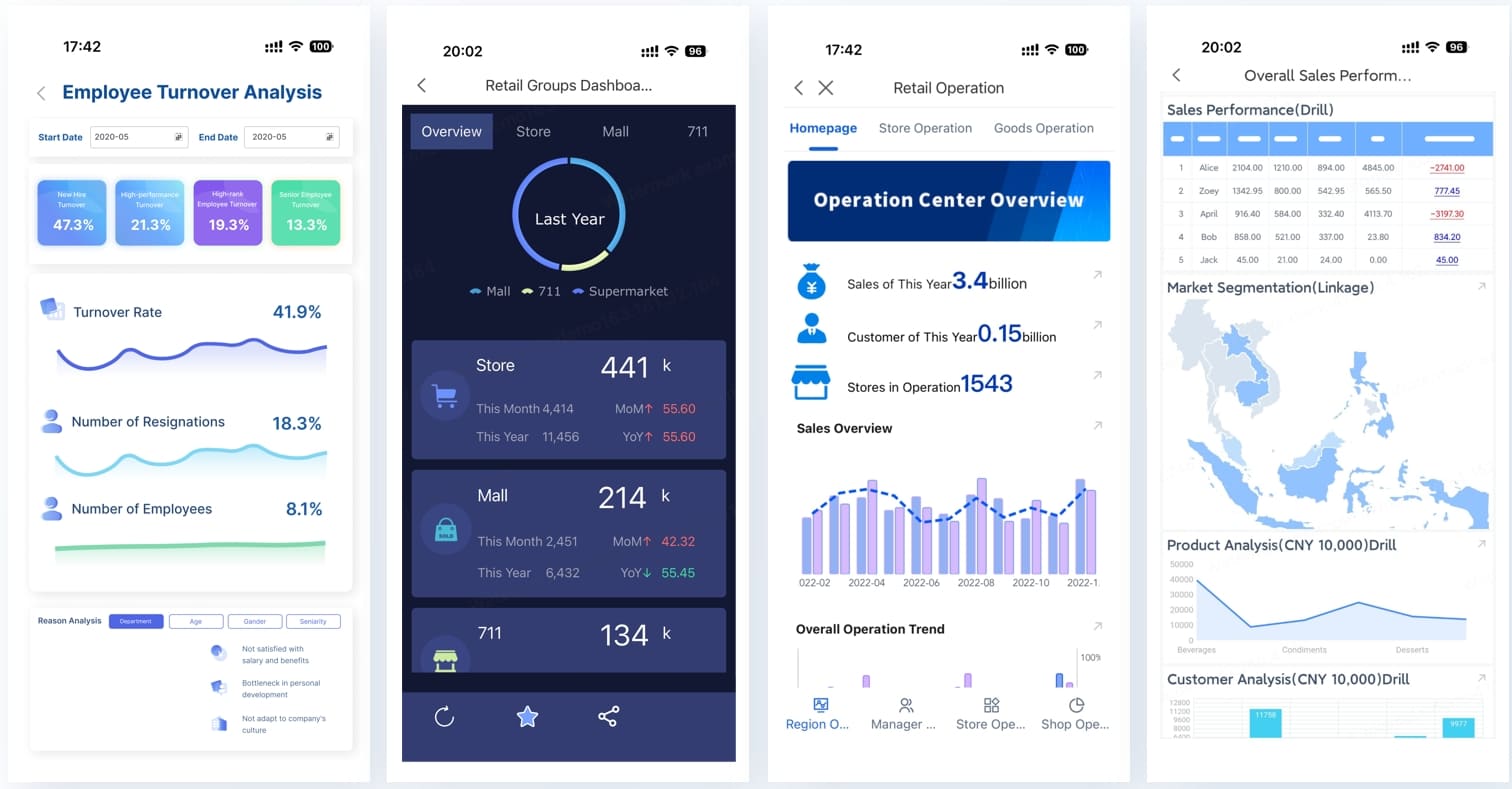

FineReport’s visualization tools transform audit data into interactive charts and dashboards. These visualizations help you identify trends, risks, and opportunities quickly. With over 70 chart styles, you can customize your reports to highlight key findings effectively.

Real-time reporting ensures you stay updated on critical metrics. FineReport’s mobile capabilities allow you to access dashboards on the go, making it easier to monitor audit progress and share insights with stakeholders. This dynamic approach enhances transparency and supports informed decision-making.

Note: Visual dashboards make complex audit data easier to understand. Use them to communicate findings clearly to stakeholders.

An audit report provides a clear evaluation of an organization’s financial health. It ensures transparency and accountability, helping you trust the accuracy of financial statements. Audits also promote compliance with regulations, reducing risks and improving operational efficiency. These reports guide strategic decisions by offering actionable insights into risks and opportunities.

Tools like FineReport simplify audit reporting. Its drag-and-drop interface and real-time data integration streamline the creation of detailed reports. You can use its visualization features to present audit findings clearly, fostering better communication with stakeholders.

Click the banner below to try FineReport for free and empower your enterprise to transform data into productivity!

The Author

Lewis

Senior Data Analyst at FanRuan

Related Articles

Top 10 Best Automation Reporting Tool Picks for Businesses

Compare the top 10 best automation reporting tool options to streamline business data, automate reports, and boost decision-making efficiency.

Lewis

Jan 03, 2026

Top 10 Reporting Systems and Tools for Businesses

See the top 10 reporting systems that help businesses automate data, build dashboards, and improve decision-making with real-time analytics.

Lewis

Jan 03, 2026

What is integrated reporting and why is it important

Integrated reporting combines financial and non-financial data, offering a full view of value creation, transparency, and stakeholder trust.

Lewis

Dec 12, 2025